glenwood springs colorado sales tax rate

You can find more tax rates and allowances for Glenwood Springs and Colorado in. The 86 sales tax rate in Glenwood Springs consists of 29 Colorado state sales.

Special Event Sales Tax Department Of Revenue Taxation

If you need assistance see the FAQ.

. Name Garfield County Treasurers Office Address 109 8th Street Glenwood Springs Colorado. Wayfair Inc affect Colorado. The tax which will take effect Jan.

The Colorado sales tax Service Fee rate also known as Vendors Fee is 00400 40 with a Cap of 100000. - Tax Rates can have a big impact when Comparing Cost of Living. RTD salesuse tax parts of Weld County that have been annexed by the city of Longmont and the.

Glenwood Springs CO Sales Tax Rate. 307 City of Colorado Springs self-collected 200 General Fund 010 Trails Open Space and Parks TOPS. Home is a 4 bed 30 bath property.

One of a suite of free online calculators provided by the team at iCalculator. 1 2020 will impose a new tax of 20 cents per cigarette or 4 per pack on 20 cigarettes sold. To begin please register or login below.

Glenwood Springs limits 001 000 RTA Regional Transportation Authority Roaring Fork Aspen and. Income and Salaries for Glenwood Springs - The average income of a Glenwood Springs resident is 28606 a year. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

View more property details sales history and Zestimate data on Zillow. City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone. The Glenwood Springs sales tax rate is 37.

Use Tax Rates for Districts in Colorado. The County sales tax rate is 1. Granby CO Sales Tax Rate.

Has impacted many state nexus laws and sales tax collection requirements. GLENWOOD SPRINGS City sales tax revenues last year climbed to 1649 million their highest figure yetAt a 37 percent sales tax rate that means Glenwood saw about 44562 million in taxable sales last year about 43 million more than the year before. The Colorado sales tax rate is currently.

The Colorado sales tax rate is currently 29. But the last six months of the year didnt. Gold Hill CO Sales Tax Rate.

The County sales tax rate is. Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57. 6 rows The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state.

The Colorado Springs sales tax rate is. Did South Dakota v. Average Sales Tax With Local.

Service Fee Notes Applies to Exemptions Use Tax Rate Use Tax Applies Page 2 of 22. 497-131 County Rd Glenwood Springs CO 81601 is a single-family home listed for-sale at 1300000. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date.

Golden CO Sales Tax Rate. Sales tax rate in Glenwood Springs Colorado is 8600. MUNIRevs allows you to manage your municipal taxes licensing 24x7.

Gleneagle CO Sales Tax Rate. Glenwood Springs Colorado and Aurora Colorado. Granada CO Sales Tax Rate.

Grand County CO Sales Tax Rate. Standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes assume a new. There are a total of 223 local tax jurisdictions across the state collecting an average local tax of 3419.

The combined amount is 820 broken out as follows. The Glenwood Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Glenwood Springs Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Glenwood Springs Colorado. The US average is 73.

4 rows Glenwood Springs CO Sales Tax Rate The current total local sales tax rate in Glenwood. The US average is 46. Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8.

- The Income Tax Rate for Glenwood Springs is 46. Goldfield CO Sales Tax Rate. This is the total of state county and city sales tax rates.

- The Sales Tax Rate for Glenwood Springs is 86. 13 rows Sales Tax Rates in the City of Glenwood Springs. The 2018 United States Supreme Court decision in South Dakota v.

Net taxable sales greater than 100000000 Service Fee reduced to zero. Address Phone Number and Fax Number for Garfield County Treasurers Office a Treasurer Tax Collector Office at 8th Street Glenwood Springs CO. Ballot Issue 2A asked Glenwood Springs voters whether or not taxes should be increased by up to 900000 annually in 2020 and by such amounts which may be generated annually thereafter.

Grand Junction CO Sales Tax Rate. The sales tax is remitted on the DR 0100 Retail Sales Tax Return. Sales Taxes Amount Rate Glenwood Springs CO.

Utah Sales Tax Rates By City County 2022

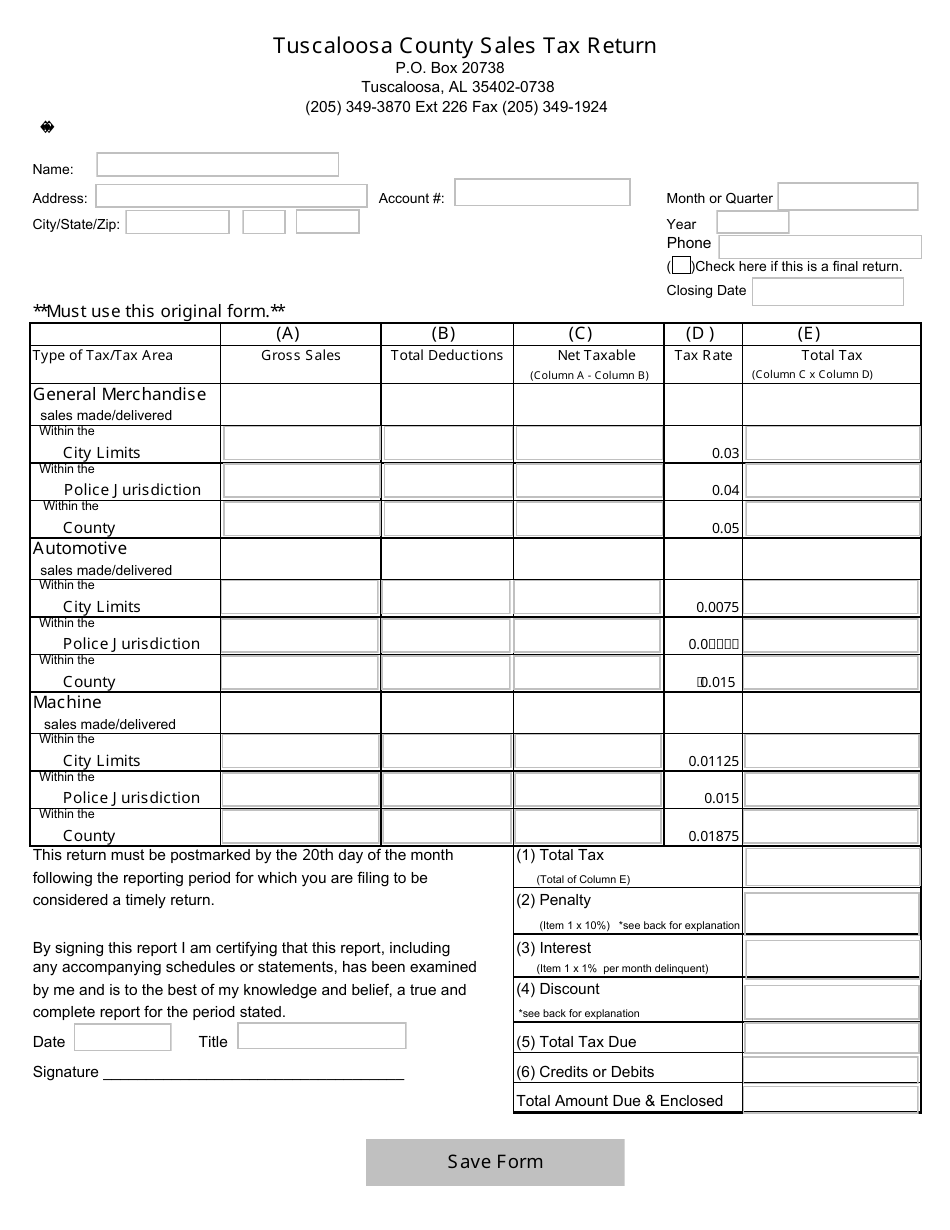

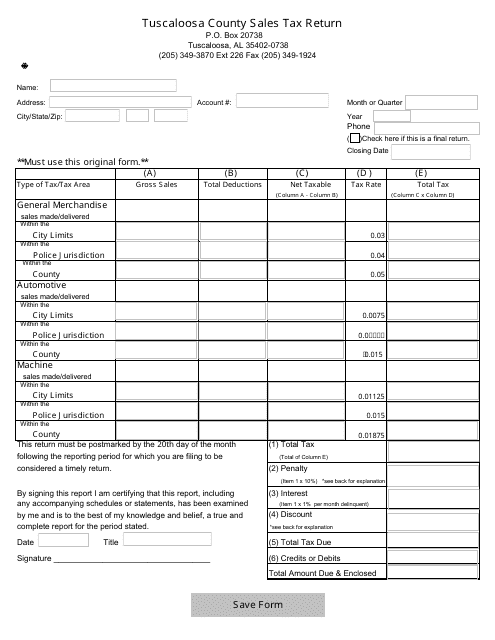

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

Florida Sales Tax Rates By City County 2022

Colorado Sales Tax Rates By City

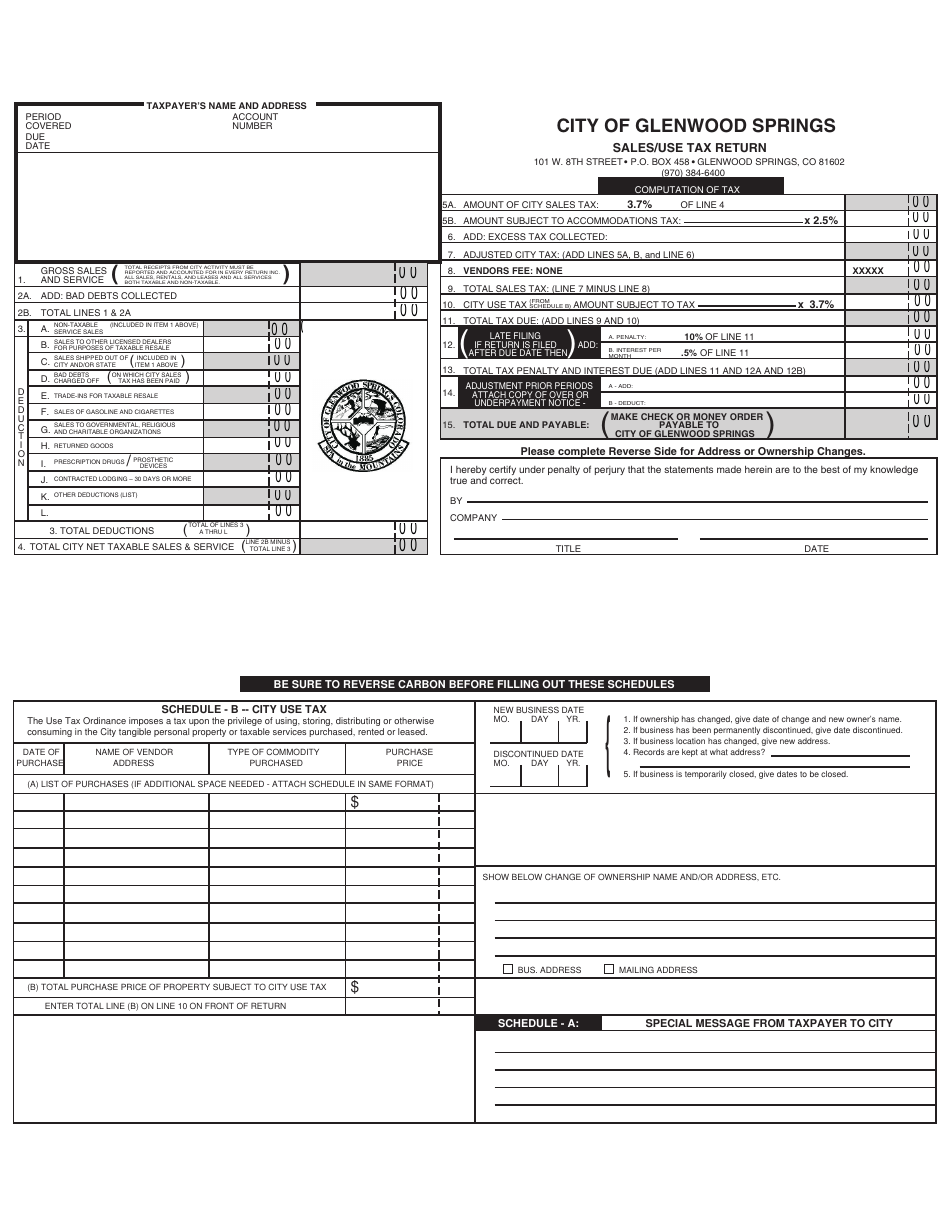

City Of Glenwood Springs Sales Use Tax Return Form Download Printable Pdf Templateroller

Missouri Sales Tax Rates By City County 2022

Gj S Combined Tax Rate Would Be Among State S Highest If Measures Pass Western Colorado Gjsentinel Com

Colorado Sales Tax Rates By City County 2022

Glenwood Springs Economy Is Strong As City Reports Sales Tax Collection Exceeded 2021 Forecast Aspentimes Com

Washington Sales Tax Rates By City County 2022

Georgia Sales Tax Rates By City County 2022

Gj S Combined Tax Rate Would Be Among State S Highest If Measures Pass Western Colorado Gjsentinel Com

Alabama Sales Tax Rates By City County 2022

Price Quotation Templates With And Without Tax Excel Templates Excel Templates Quotation Format Quotations

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar